If you are here, then you might be looking for some crucial insights to kickstart your streaming business. You are on the right track!

Video streaming is part of a consumer’s lifestyle like other household items, thanks to giants like Netflix, Hotstar, disney+, Twitch and more. Undoubtedly, it is convenient and offers much higher levels of interaction and engagement than TV or other mediums. However, to stand out in such a competitive market you must be aware of current market trends and understand what your customers are actually looking for to serve them the best content.

Now, let’s start first with the time when it started to soar!

Well, the Covid-19 pandemic is unforgettable. During the lockdown in 2020, the viewership of video streaming services increased massively. This was even the prime reason for the rise of video streaming stats and increased usage of VPNs.

- According to a Forbes study, by June 2020, 48% of US online adults had subscribed to at least one streaming service.

- A survey of 1,005 American consumers commissioned by Forbes Home and conducted by Prolific found the most popular type of digital subscription are streaming services, which 90% of consumers subscribe to.

- Forbes also found that four of the five subscription categories deemed most important by Americans are entertainment-related: streaming, music, live TV and gaming.

- Since 2020, Netflix’s reign has fallen a bit as the streaming wars gave way to the rise of competitors like Apple TV, HBO Max and others.

What about now?

- According to Conviva’s state of streaming Q2 2022 report, it has been analyzed that we are using streaming services more frequently. As mentioned earlier, there was a huge jump in video streaming stats during the pandemic, but also there has been an average increase of 14 per cent globally from Q2 2021 to Q2 2022.

- Moreover, Nielsen’s The Gauge report found that video streaming stats accounted for almost 40 per cent of all TV time in December 2022.

Considering the growing demand for global video and audio streaming, here’s what the recent market report estimates:

Table of Contents

- 1 The global streaming market will be worth upwards of $1.9 trillion by 2030

- 2 Region-wise analysis of the video streaming industry

- 3 Video Consumption Consumer Habits Stats (Globally)

- 4 OTT & Streaming Platform Stats

- 5 OTT Revenue Based on Monetization Models

- 6 Subscriber Churn Stats to Know in 2023

- 7 Popular Streaming Platforms by Costs

- 8 Understanding What Customers Want

The global streaming market will be worth upwards of $1.9 trillion by 2030

- According to Fortune Business Insights, the global video streaming stats market was worth 455 billion in 2022, with an expected growth of around 19.3 % per year until 2030, when the industry would be worth $1.9 trillion.

- There has been a significant increase in the market value from previous forecasts and future estimates at around $184.3 billion in 2027.

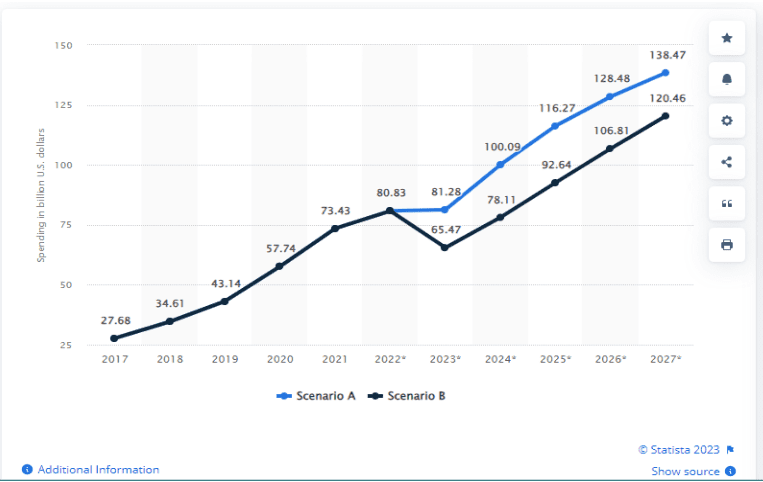

- Moreover, if we consider the OTT video segment below is the consumer spending on over-the-top (OTT) video services worldwide from 2017 to 2027. (Source: Statista)

Region-wise analysis of the video streaming industry

It is no surprise that some of the regions accounted for larger increases than others. Have a look-

- Asia’s streaming time spiked 90 percent in the last year alone, following along from a massive 172 percent increase the year prior. (source)

- As per the Grand View research report, North America accounted for the maximum revenue share, i.e. 31.9% of the video streaming stats market in 2022.

- Post-pandemic, the number of streaming subscribers in the US doubled — from an already impressive base of more than 125 million.

- The European region is estimated to witness rapid growth in the coming years due to the large population watching online content. (Source)

- APAC region is projected to register significant growth owing to the massive tech advancements, the popularity of online streaming stats and increased usage of mobile and tablets. (Source)

Video Consumption Consumer Habits Stats (Globally)

- Nearly half (42%) of people keep the cord (don’t cancel their cable) due to live TV. However, 30% of cable keepers said they would cut the cord if they knew they could stream all of their favourite live sports, events, and news (Adobe).

- At present, around 54% of consumers want to see more video content from businesses and brands they support (HubSpot).

- About 60% of young adults in the US primarily use online streaming to watch TV (Pew).

- U.S. adults now spend nearly 6 hours per day watching videos. In fact, the time span (5:57) represents an 11-minute increase in video consumption, with 6 of those 11 minutes from TV-connected devices (Nielsen).

- Demographics are no longer an accurate predictor of video consumption as the behaviour of younger and older generations is starting to converge. 28% of older consumers (50+) have cut the cord, up from 19% in 2017 (As per the PWC report).

- Consumers have a low tolerance for a bad stream. For many, 90 seconds is the most a viewer will tolerate a stream with a lot of buffering (Techradar).

- 29% of consumers believe that they would pay a premium if 5G provided “better quality video” on mobile devices and “decreased buffering while streaming video” (PWC).

- Consumers are 39% more likely to share content if it’s delivered through video (Forrester).

- Nearly 80% of content owners and marketers recognize video (including TV, digital video, social video, and OTT video) as an increasingly important medium (4CInsights).

- Online videos with a start-up time greater than two seconds have significantly higher streaming video abandonment rates, with each additional second prompting another 6% of viewers to bounce (Akamai).

- While video can help convert customers already on a path to purchase, it also enables a retailer’s existing customers to increase reach to friends and family, and 48% of consumers have shared a brand video on their social media profile (Forrester).

OTT & Streaming Platform Stats

- According to Forbes Home Survey, Netflix along with Prime Video, are the most used paid streaming services in the U.S.

- Amazon Prime was launched as a subscription to the eCommerce giant’s express shipping service. By expanding subscription benefits to include Prime Video streaming, Amazon quickly grew its customer base to 172 million subscribers. (Source)

- Disney acquired BAMTech in 2016 to help build out and launch its video streaming service Disney+. Since its launch in 2019, the platform has amassed 152.1 million subscribers. (Source)

- Five apps (Amazon Video, Disney+, Hulu, Netflix, and YouTube) account for 80% of all connected TV viewing. (Comscore)

- Home Box Office (HBO) was founded in 1972 and shifted its focus over time from traditional Pay TV to OTT streaming services. HBO and HBO Max are now owned by Warner Brothers and have a total of 76.8 million subscribers. (Source)

- As of December 2022, the number of Disney+ subscribers reached 164.2 million. When combined with its other DTC subscription services, Hulu and ESPN+, the figure tallies around 235.7 million, surpassing Netflix for the first time. (Source)

- The number of Apple TV+ paid subscribers was estimated to be around 25 million as of March 2022. Additionally, there are around 50 million users worldwide who access the SVOD via promotions, this happened as the service is available for free for 1 year with the purchase of new Apple devices. (Source)

- Warner Bros. Discovery reported 94.9 million active sign-ups in Q3 2022 (combining Discovery+, HBO Max, and HBO)—on track, it says, to reach more than 130 million by 2025. (Source)

OTT Revenue Based on Monetization Models

- OTT revenue from video advertising, or advertising video-on-demand (AVOD), services is expected to surpass $318 billion by 2027 (Source)

- OTT revenue from subscription streaming platforms or subscription video-on-demand (SVOD) is expected to surpass $139 billion by 2027 (Source)

- OTT revenue from pay-per-view, or transactional video-on-demand (TVOD), is expected to surpass $12 billion by 2027 (Source)

- The Statista report reveals that the largest segment of OTT is AVOD, with a market volume of $180 billion in 2022 (Source)

- 57% of U.S. adults prefer low-cost or free OTT streaming platforms with advertisements (Source)

- The average revenue per user for OTT video advertising is expected to reach $52.25 by 2025 (Source)

- Deloitte Global predicts by the end of 2023, approaching two-thirds of consumers in developed countries will use at least one advertising video-on-demand (AVOD) service monthly—a 5% increase over the prior year.

- All major subscription video-on-demand (SVOD) services in developed markets will have launched an ad-funded tier to complement ad-free options by 2023 end. (Source

- By the end of 2024, half of these providers will also have launched a free ad-supported streaming TV (FAST) service. And, by 2030, it is expected that most online video service subscriptions will be partially or wholly ad-funded. (Source)Let’s understand!

You might be wondering what’s the reason for the sudden spike in AVOD?

Currently, a fundamental driver for adding AVOD is to generate an additional revenue stream from advertising and avoid the churn rate.

- AVOD both offers an entry-level price option to new subscribers and also a lower-cost option to existing subscribers who might otherwise cancel (churn from) a service. (Source)

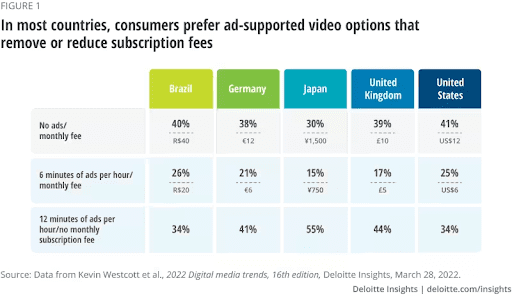

- A survey by Deloitte Global reveals the consumer’s preference in several markets on which service tier they would select when subscribing to a new streaming video service. In all markets, the majority of customers said they would select an ad-supported tier, either at no cost or for free.

Source: Deloitte

As of mid-2022, many VOD-only content players were operating at a loss, with profitability contingent on adding users. For traditional broadcasters, AVOD undoubtedly offers an additional source of revenue, drawn from linear ad budgets, and, importantly, online video ad budgets.

Subscriber Churn Stats to Know in 2023

Besides the massive increase in AVOD, streaming subscriptions and subscription churn remain an unavoidable challenge for content providers. In such a case, the focus has to be switched from driving user acquisition to subscriber retention.

- In Q3 2022, streaming platforms added 37.2 million subscriptions yet suffered 32 million cancellations for a net gain of 5.2 million accounts. This churn will continue into 2023: less than half of subscribers plan to retain their same packages the whole year, while slightly more customers will add new accounts than cancel.

- As per the recent report, the primary reason subscribers ditch streaming platforms is a lack of interesting content. (Source)

- Earlier, Netflix’s churn has hovered between 2% and 3% for nearly the entire period. It is the lowest compared to all other OTT platforms, including Disney+, Hulu, Starz, Showtime and HBO Now.

- The U.S. followed with a churn rate of 37 per cent among other countries where consumers cancelling paid streaming video services in the last six months in 2022. The churn rate was more significant with Generation Z and millennials instead of boomers and Gen X. On the other hand, in Germany, the share of consumers in the Gen Z and millennials generation cancelling an SVOD subscription was about four times higher than for boomers or matures. (Statista)

Popular Streaming Platforms by Costs

Costs also play a crucial role for customers who want to choose a primary subscription service for entertainment.

- Currently, Netflix is the most used streaming platform and comes out at the top with the highest monthly cost at $15.49 followed by HBO Max at $14.99 and Hulu at $12.99 per month.

- Apple TV had the lowest streaming cost at $4.99 per month and Discovery+ was slightly higher at $6.99 per month and Disney+ at $7.99 per month.

- On the other hand, Paramount, Peacock and Prime Video round out the middle at $9 to $10 per month.

Understanding What Customers Want

Today the viewers expect you to know them and help them through the search and discovery process. Netflix is a great example of that. Also, there are multiple ways on how you can reduce the churn rate.

Below are the top factors you must consider in your video streaming or live streaming platform-

Read also: https://www.enveu.com/blog/4-ways-to-reduce-your-ott-churn/

(Souce- PwC)

All-in-All

Don’t let the idea of creating a streaming app intimidate you – with the right resources and a whole lot of creativity, you can create a fully-fledged online streaming platform that not only delivers your content but provides a unique and engaging user experience.

Both music and video content are rapidly expanding in the online streaming market. Not only are more and more individuals using these services for the convenience of being able to stream whatever they want when they want, but the number of streaming services is also increasing.

As a content broadcaster, you can get the most from the above video streaming stats for your business or brand message to maximize efficiency. Using the most advanced streaming platform, you can implement the above trends and boost your customer experience.

I hope that reading our article on video streaming services statistics will help you to add the best for you as a new entrant in the market. Please let us know in the comments about your thoughts on the blog. You can also connect with us at https://www.enveu.com/contact/.